Convincing Your Sceptical CFO That AI Can Help You Hit the Pricing Sweet Spot

When engaging retailers in discussions about AI-driven lifecycle pricing solutions, there are usually two types of decision makers. The first are senior decision makers, namely CFOs who need strategic control and visibility of business performance and operations. They also have the budget needed to make investment decisions.

While focused on business efficiency and margin, they may approach decision making differently, with a greater focus on strategic control and visibility. But being several steps away from the work of pricing decisions, they need more persuasion to grasp the return on investment (ROI).

And then there are those on the front line responsible for overseeing pricing decisions, who more quickly grasp the benefits of AI-driven pricing solutions, as it's what they specialise in every single day. They're the ones always looking for the ideal markdown 'sweet spot' for every stock keeping unit, accelerating sell-through while preserving margin. These people are key internal influencers with the more senior stakeholders like the CFO.

But without a unified, data-driven markdown strategy, they're often the first to recognise their approach needs improvement, which is a good thing. Getting the right solution requires understanding where you are when it comes to approaches to pricing and where you want to be.

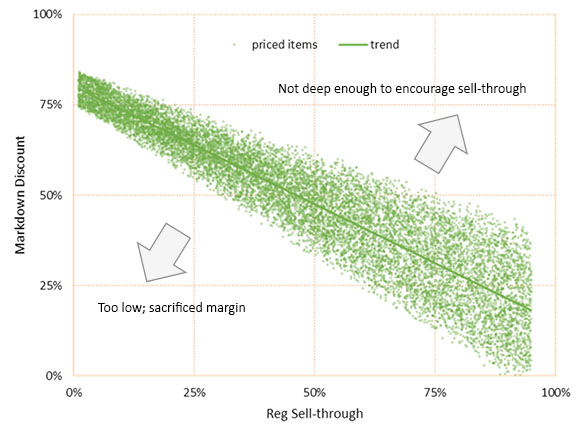

A compelling business case backed up with visually presented data can go a long way in explaining visibility, strategic control and ROI to senior decision makers, as David Barach, Senior Director for Retail Software Solution Strategy at antuit.ai? did for the women's wear division of a large North American retailer. The team worked from a data set of the company's actual markdown history over the course of a year—over 12,700 items spanning seven departments, totalling $63 million (£57m) in markdown sales.

This first chart illustrates the correlation between markdowns and sell-through in a 'perfect world' scenario. David explained that every green dot represents a single markdown-priced item. Hypothetically, markdowns shouldn't stray too far from a diagonal trendline—discounts should not be unnecessarily too low, nor too steep, to spur optimised sell-through.

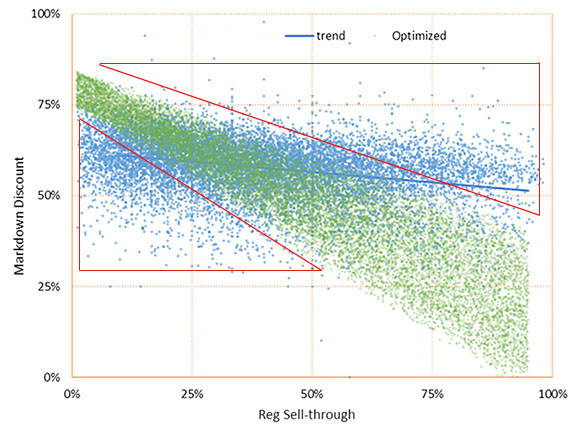

He and the team then plotted the company's actual sales—individual marked-down SKUs represented by the overlay of blue dots. We can see the trendline here is far less dynamic—almost horizontal versus diagonal.

The particularly troubling aspect of this chart is the number of dots that trend within the red triangles. These represent markdowns that either weren't attractive enough to accelerate slow-selling items or unnecessarily deep discounts that ate away at margins. Both resulted in direct losses of net revenue.

How do so many of the dots wind up in the triangles? Particularly among fashion retailers, markdowns are left to various individual buyers and merchandisers. Even those who don't consider this the 'least glamorous' part of their job aren't born number-crunchers.

They're reliant upon inadequate tools—piecing together sell-through rates and price adjustments via cumbersome spreadsheets—without the benefit of real data to guide their decisions. Those stray blue dots at the far reaches of the chart may as well have been determined by a dart board.

When we can simplify these numbers visually, we can help lay the groundwork for a compelling business case and answer commonly asked qualifying questions:

- What would be the advantages of eliminating a significant percentage of the blues?

- What if we could stop taking discounts that aren't moving inventory?

- What if we could get a better grasp of what those items are and be more knowledgeable as we're making changes?

- Would we feel better that we're not just slashing everything when trying to exit the season?

- Would we be more confident in decisions and results when we're stuck in an overstock situation, and need a clear and quick path out of it?

- What might all those benefits be worth—ROI as well as better allocation of resources?

While any vendor is quick to throw together a demo or pilot, what an AI-driven lifecycle pricing solutions specialist can do for retailers is demonstrate how to increase strategic control of pricing decisions—creating far more green dots than blue—to easily win over any sceptical CFO. In this case, David and his team estimated this retailer could increase revenue by 5% or $3.1m (£2.8m) in sales, with $2m (£1.8m) in margin.

By providing a centralised, data-driven markdown structure, we can free up merchandisers to devote more time to their most important role—looking ahead at next season and choosing attractive new merchandise that ideally never appears on the clearance rack at all.

Learn more about AI-powered pricing decision solutions here