Operations | Monitoring | ITSM | DevOps | Cloud

Latest News

Why Operational Maturity Helps Businesses Reduce the Great Resignation Trend

The past few years have led to fundamental business and cultural shifts for both companies and employees. Covid-19 has brought opportunities for companies who invested early in digital operations, while others struggled to maintain the status quo. The latter gave rise to record employee burnout, and what is now commonly referred to as the Great Resignation.

How Does ITSM and ITOM Work Together?

How an integrated ITSM and ITOM platform can help you accelerate it

Summit Recap: How to adapt to a "Digital Everything" World

Every interaction with our customers, partners, and employees is special – but this year’s PagerDuty Summit went far beyond my wildest dreams. Together we committed to helping you learn and grow in how you manage business critical operations – in other words, getting you ready for anything in a world of Digital Everything.

Ready for Anything with the PagerDuty Operations Cloud

In a world of digital everything, teams face increasing complexity. Ever-growing dependencies across systems and processes put customer and employee experience, not to mention revenue, at risk. There is simply too much data to sift through and correlate for humans to understand what is important and know when something is going wrong.

A "Single Source of Truth": New Tools for Fast, Efficient Customer Service

Customer-facing teams have their hands full doing whatever they can to address customer issues quickly. At PagerDuty, our goal is to ease the burden of these teams by giving them the tools and access they need to deliver excellent customer experiences. Over the last year, we have deepened our integration with Salesforce Service Cloud, allowing users to work directly within the platform, reducing the need to context switch.

What is Automated Diagnostics and Why Should You Care?

A lot of people in technology talk about the cost of an incident solely from the perspective of downtime, or the number of customers and employees impacted. And from the surface, oftentimes that is a fair angle to take. It makes the headlines, and customer reputation and trust are critical to the success of any business—obviously.

5 Benefits of Operations Management Software For Insurance Companies

Operations management software is a must-have for insurance companies. From managing policies and processing claims to storing customer data and analyzing trends, insurance companies use operations management software to centralize a full range of processes. This article will explore the benefits of operations management software for insurance companies. StartingPoint has become a go-to platform for insurance companies looking to streamline their processes and embrace workflow automation.

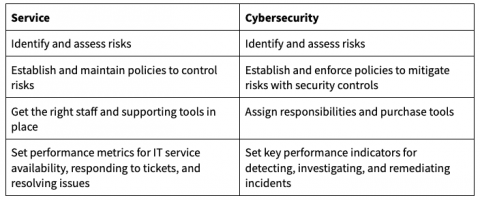

Use Service Design in Operations Management to Enhance Security

As an IT operations manager, you spend a lot of your time mitigating service outages and service level risks. You worked diligently to get the right people, products, processes, and partners in place to meet your goals. You managed to ensure continued uptime. You’ve reduced the number of tickets and the cost per ticket. And for your efforts, you’re rewarded with managing your company’s cybersecurity program. The problem? You’re not a security specialist.